Solutions Candidate Verification for HR Teams

Candidate Verification for HR Teams: Safeguard Your Hiring and Onboarding Process

Prevent Interview Fraud: Interview Real People, Everytime

Combat the rising threat of fake applicants. HYPR Affirm ensures that HR teams only screen and interview real people.

Location and Device Check

Document Verification

Facial Recognition and Liveness Detection

HR Identity Verification Challenges

Fraudulent hires aren’t just a nuisance — they’re a risk.

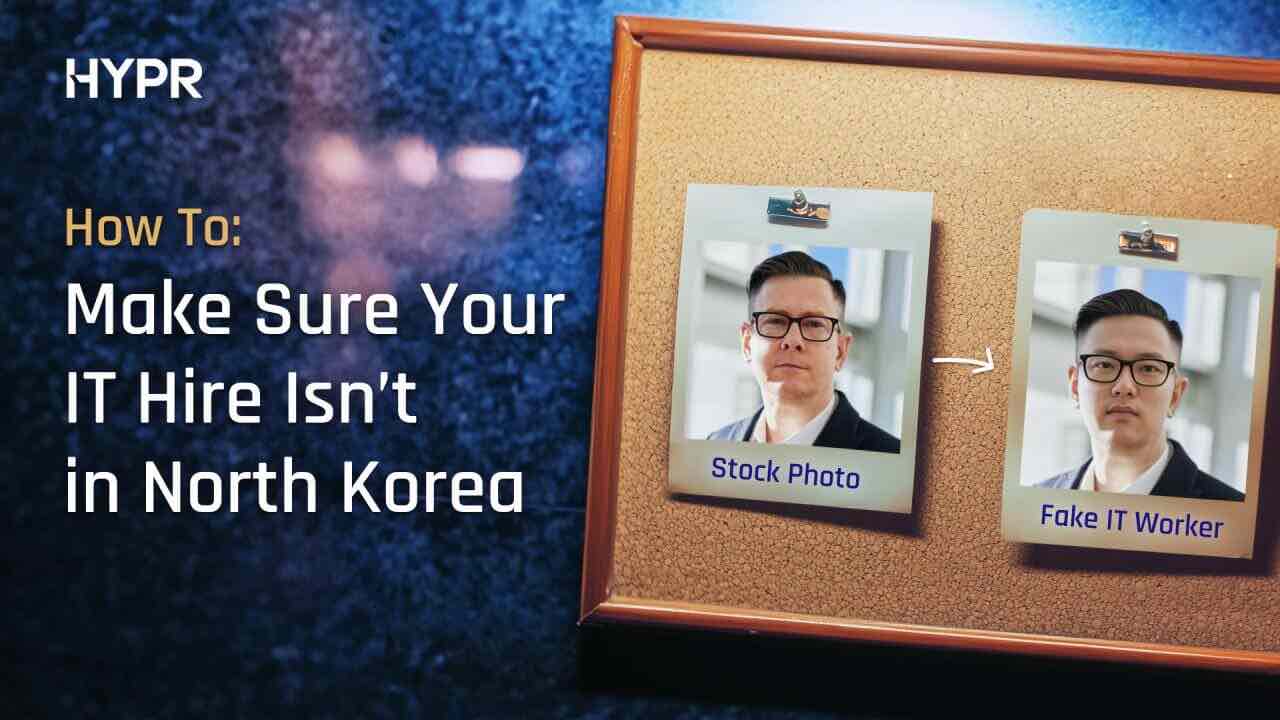

- Candidate Fraud Risk: Tactics such as interview deception and bait-and-switch scenarios can result in hiring individuals who aren’t who they claim to be; potentially leading to security risks and damaging the hiring process.

- Risk of AI-Generated Fake Applicants: AI-generated personas can easily bypass traditional verification methods, causing potential harm to recruitment efforts and overall security.

- Inefficient Onboarding: Outdated verification processes can slow down the hiring process, creating delays and reducing productivity.

- Compliance and Data Privacy Concerns: Inaccurate or inadequate handling of personally identifiable information (PII) can result in breaches and legal challenges, especially as privacy regulations tighten globally.

Eliminate Candidate Fraud

HYPR Affirm offers HR departments a comprehensive identity verification solution that automates much of the initial candidate screening process and ensures only real candidates progress through to interviews.

Stop Fraud Before It Enters Your Hiring Pipeline

- Authentic Document Validation: Accurately verify passports, driver’s licenses and other government-issued IDs across multiple regions using advanced fraud detection to spot tampering or counterfeits.

- Geolocation Confirmation: Analyze a candidate’s location data to ensure consistency with expected hiring regions, while maintaining compliance with international privacy regulations.

- Advanced Facial Recognition: Leverage facial matching to detect impersonation attempts, including deepfakes and photo-based fraud.

- Secure Chat-Based Verification: Enhance identity validation through a secure chat system designed to prevent manipulation or spoofing.

- Live Video Confirmation: Strengthen applicant verification with a secure, real-time video process that ensures the person behind the screen is who they claim to be.

- Peer-Based Attestation: Add an extra layer of security by enabling hiring managers to formally verify an employee’s identity within the hiring process.

Simplify and Accelerate Hiring

- Faster Screening: Automate a customizable verification process, allowing more time to focus on top talent.

- Higher Accuracy: Identify the best, and real, candidates with confidence.

- Better Experiences: Create a seamless and secure process for HR and applicants alike.

Protect Sensitive Data and Internal Systems

- Access Control: Only legitimate candidates gain entry to your systems or network.

- Privacy Compliance: Advanced encryption minimizes PII exposure and adheres to data regulations.

- Organizational Security: Stop bad actors from infiltrating your systems on Day 0.

Candidate Verification Flow

HYPR Affirm can be customized and deployed at any stage of the applicant process, allowing organizations to perform identity verification exactly where it’s needed, ensuring flexibility and alignment with existing HR workflows.

Other Identity Verification Resources

Request a Demo

Experience passwordless MFA that secures and empowers your business. See what identity verification built for the workforce looks like. Learn how comprehensive Identity Assurance protects the entire identity lifecycle.

Get a demo from an identity security expert, customized around your organization’s environment and needs.